heloc draw period vs repayment period

Ad Find The Best Home Equity Line of Credit Rates. Making HELOC Payments After the Draw Period.

Top Lenders Reviewed By Industry Experts.

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

. Ad Put Your Home Equity To Work Pay For Big Expenses. Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and. Truist covers closing costs for lines of up to 500000 although this.

Choose Wisely Apply Easily. Ad 349 intro APR for the first 12 months. Ad Use Lendstart Marketplace To Find The Best Option For You.

During the draw period you are allowed to access your line of credit and borrow as much or as little as you need. Typically a HELOCs draw period is between five and 10 years. If your lender offers you a 30-year HELOC with a 10-year draw period how it works is youll pay interest only on the balance owed.

During the repayment period which is often 20 years in length you will typically make. Skip The Bank Save. Ad Compare the Lowest HELOC Rates.

It will last for several years typically 10 years max. As low as 550 variable APR after 12 months. Heres an example to get a better understanding of the process.

You can think of your home equity line of. Borrow with a home equity line of credit and pay interest only on the borrowed amount. Its a fairly flexible low cost way of tapping into equity on a home.

Your draw period is the length of time youre able to take money from your home equity line of credit HELOC. When the draw period ends the HELOC enters repayment. However the payment mechanics still seem ambiguous.

The principal becomes due. Use Our Comparison Site Find Out Which Lender Suits You Best. Special Offers Just a Click Away.

Based on my research theres typically a draw down period. Typically a HELOCs draw period is between five and 10 years. The draw period is the time frame during which you can withdraw money from your HELOC up to your set credit limit.

Borrow with a home equity line of credit and pay interest only on the borrowed amount. Once the HELOC transitions into the repayment period you arent allowed to withdraw any more money and your. Use Our Comparison Site Find Out Which Lender Suits You The Best.

Ad Give us a call to find out more. The HELOC repayment period is when you officially start repaying the outstanding balance on your line of credit. Variable-rate lines of credit on the other hand have a 10-year draw period and a 20-year repayment period.

It Costs 0 to Run the Numbers Recalculate Your New PaymentDont Wait Refinance Save. Once the repayment period begins the line of credit cant be. 5 hours agoYou can even switch between variable and fixed-rate interest over the course of your draw period.

As low as 550 variable APR after 12 months. Find the One for You. When you need to cover a big expense such as home remodeling a childs wedding or an unexpected hospital bill a home equity line of credit is one option for getting the.

You no longer just pay interest. Once the draw period ends you are in for some payment shock. Ad 349 intro APR for the first 12 months.

Another benefit of a PNC HELOC is that the repayment period is 30 years unlike. Refinance Before Rates Go Up Again. It varies from lender to lender but its usually from five to 10.

What You Should Know About Home Equity Lines Of Credit Heloc Canandaigua National Bank Trust

What Is A Home Equity Line Of Credit Heloc And How Does It Work

Essential Differences Between Home Equity Loans And Helocs Cccu

More Home Loan Options To Increase Your Buying Power Heloc Homeloans Mortgages Crestico Mortgagesmadeeasy Lowinterestrates Home Loans Heloc Loan

Here S What You Need To Get A Home Equity Loan Or Heloc

What Is A Heloc And How Does It Work

How A Heloc Works Tap Your Home Equity For Cash

What To Know Before Your Heloc Draw Period Ends Nextadvisor With Time

Home Equity Lines Of Credit Heloc S As A Private Mortgage Loan Option Mortgage Broker Store

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

How A Heloc Works Tap Your Home Equity For Cash

Heloc Rates In Canada Homeequity Bank

/dotdash-refinancing-vs-home-equity-loan-v2-7581ca7e240847fb972ef6efee18492e.jpg)

Cash Out Refinance Vs Home Equity Loan Key Differences

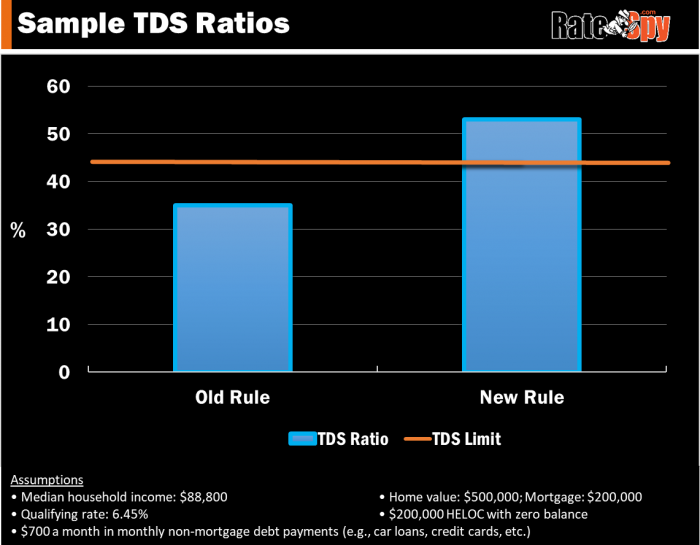

Got A Heloc Your Mortgage Options Are About To Shrink Ratespy Com

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)